Avoiding Groupthink (Part 1 of 3)

This week I’m kicking off a three-part series. We are going to squash groupthink one week at a time. Feel free to read weekly or binge at the end. First up: fighting personal finance groupthink.

What is “groupthink”? Groupthink is the practice of thinking or making decisions in line with a particular group in a way that discourages creativity or individual responsibility.

Remember the Occupy Wall Street movement? Remember “We are the 99%“? This phrase directly refers to the income and wealth in the United States that is concentrated among the top earning 1% of people. It reflects an opinion that the “99%” are paying the price so that the upper class of Americans can thrive.

Statistics are fun and interesting, but let’s dive a bit deeper. As of 2009, any household with an income less than $343,927 belonged to the lower 99% of the United States’ income distribution, according to IRS reports. Wait, what?!

$343,927?! So if a household makes $343,926 a year they are considered part of the disenfranchised majority that is being crushed by the oppressive 1%! My response:

(I’m going to avoid politics and purposefully swerve around discussing income redistribution and wealth inequality, and if people want to vilify the top 1%, fine! I’ve got an idea, though: let’s all shoot for being in the top 2% or even just 5%, how’s that?!)

We are ALL likely looking at the wrong metric. There are plenty of examples of high earners who, if they lost their jobs tomorrow, would be penniless inside of three weeks.

There is no doubt we should be on a quest to authentically raise our household income. But as a part of our financial planning, we should also be focused on growing our net worth by increasing our savings rate. Here is the basic equation:

Income Saved

——————— x 100 = Savings Rate (as a percentage)

Income Earned

Just a quick example, if you had a household income of $50,000 and you save $5,000 of it. That would be:

$5,000

——————— x 100 = 10% savings rate

$50,000

THE REALITY

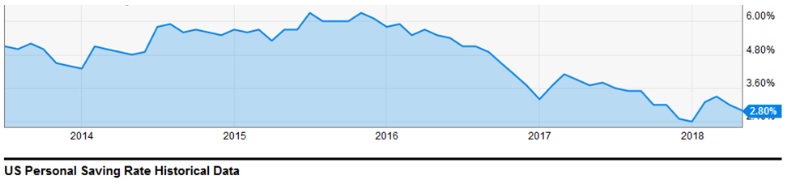

Here is how average Americans are doing with their Household Savings. This is a five-year graph that basically shows the downward trend. The 2018 numbers are hovering between two and three percent. This is downright scary for the future of America.

THE PREVAILING GROUPTHINK

So you are reading this piece, you are NOT average! The Personal Finance Groupthink that is echo-chambered throughout media and personal finance books will say that your savings rate should be anywhere between 10% and 20%. It would also say that if you invest these savings over four or five decades, you’ll be able to retire. There’s nothing wrong with that plan if you love your career and want to work for 40+ years. Three Action Thursday, however, is about going beyond the prevailing groupthink.

So let’s push it a bit….

YOUR BEST PERSONAL FINANCE SELF

Many define “retirement” as being able to afford to do nothing and support your lifestyle. Planning for retirement is fine; a nobler act, though, is planning for financial independence. “Financial independence” is often defined as being able to afford to live your dream lifestyle: work if you want, volunteer, but typically stay busy by providing value back to the world. Ideally, everyone should be shooting for financial independence and sooner than groupthink retirement age.

There are many ways to do it, but for most, it will involve a significantly high savings rate. What do I mean by “significant”? Often your savings rate will need to be in the 30-70% range to amass the savings/investments needed to achieve financial independence earlier than the prevailing groupthink.

To garner that kind of savings rate you have to think about yourself and your household in a new light. You have to think of yourself as a “producer” not a “consumer”. The table indicating a 2.8% savings rate screams that most Americans are purely consumers. Adjusting your mindset to be a producer is not easy, but the formula is pretty simple:

Production – Consumption = (rising or falling) Net Worth

Examples of ways to increase production:

- Know your value – Are you underpaid?

- Develop a Side Hustle (see the personal finance section for some ideas)

- Have a consistent growth mindset

Examples of ways to decrease consumption:

- Create a budget to find money leaks

- Audit subscription or repeating costs and minimize them – Here’s how I did it.

- Resist the urge to adjust consumption upwards as production increases

**Action: My biggest recommendation is to find someone who is doing this already and pick their brain. That being said, I offer you an opportunity. If this is something you want to do, let’s connect and discuss your plan. Contact me and we’ll get the ball rolling!**

2 Comments

Chris

Think age is another factor that should be included. Makes a difference when you save early Vs later.

Paul Sjoberg

I agree, being young definitely gives you more time to accomplish an increase in production and a decrease/maintaining of consumption. But I would argue that everyone (no matter age) would benefit from these principles.