A Simple Way to Make an Extra $3,000

The last Three Action Thursday piece I wrote was centered around arbitrage as a side hustle or side business, and I doubled my money. The piece sparked more email conversations from readers than almost any piece I have ever posted! While some were upset with me and felt like I was taking advantage of others, many praised me for utilizing capitalism and secondary markets on luxury “want” items. Regardless of the type of email, I really enjoy the conversations that stem from these pieces and I would love it if you sent me some constructive criticism from time to time.

Recently YouTuber Graham Stephan put out a great primer on taxes and how to generally minimize them in a video he calls Why I Owe the IRS $1.5M. Taking a page from Graham’s book, this week I want to use a simple example to demonstrate how having a business has other benefits besides directly making you more money. Running a business, even a small one, has the potential to save you money on some expenses you would normally already have. These expenses may include mileage/gas, a portion of your home’s utilities, a home office, some insurance costs, etc. Most people know that a business generally has more tax deduction options than an individual employee does. My goal is to show you a real world example of the tax benefits of owning a business. If you add up the four income-based categories of taxation (federal, state/local, Social Security, and Medicare), the average American’s effective tax rate is a whopping 29.8%!!! In plain terms, the government takes nearly 30 cents of every dollar you earn as a tax.

Simple Scenario: Let’s pretend you want to buy a nice set of wireless headphones for $100, and you plan to use them while you work. As an employee with an effective tax rate of 30%, you have to work long enough to earn approximately $142.86 to pay for the $100 headphones. For those of you who are math-challenged, $142.86 minus 30% in taxes is roughly $100.

Summary: Government gets $42.86 of your earnings, the store gets $100 of your earnings, and you have a set of headphones.

However, if you owned a small business – even a side hustle business – you could write-off the $100 headphone purchase as a legitimate business expense. That changes the math altogether. When you earn $142.86 as business profit and you spend $100 on a business expense, only the difference is taxed. Therefore, $42.86 is all you are going to pay taxes of 30% on.

Summary: Government gets $12.86 of your earnings, the store gets $100 of your earnings, and you have a set of headphones and now you get to keep $30 of your earnings after it is all said and done.

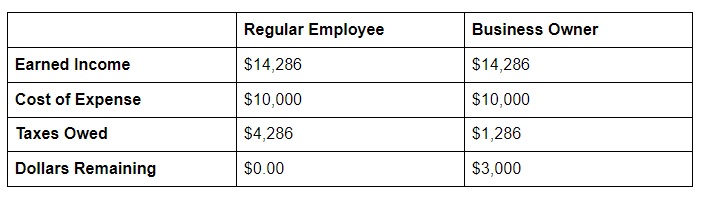

Now as we move the decimal point two places to the right, you can really start seeing the benefit of business ownership:

That resulting $3,000 difference between a regular employee and a business owner is a BIG DEAL. It can be reinvested back into growing the business or even put into investments towards retirement. Tax avoidance is not sexy but It is powerful! This is just one example of how having a side hustle or business has a significant advantage. Even if it is just a small one. I hope this real-world tax example has highlighted for you just one of the benefits of owning a business or side hustle. The tax code in the United States rewards people willing to take the risk of starting and owning a business with incredible tax advantages that are not necessarily available to someone who is just a W-2 earning employee.

**Action:

- No matter if you want to start a business or not, watch Graham’s video.

- Is there a way to reimagine something you already do as a formalized business?

- If you have NOT already optimized your tax situation, I would encourage you to talk to at least two CPAs and have them look over your past taxes and your current tax year to help you do so. There is also a chance you could get a refund for past years.**