Death of the Middle Class

In my last piece, I delivered my book review on The Psychology of Money by Morgan Housel. No matter your level of financial savvy, Housel’s book delivers thought-provoking content from which all of us can benefit.

This week, I am bringing the doom and gloom. I want to summarize how the current middle class is living in America and how, if they do not make sweeping changes, they will continue going down a path toward financial ruin.

But don’t fret, I’ll also supply an action list to bring a ray of sunshine to the situation! In all honesty whether you consider yourself part of America’s financial middle class or not, you will most definitely benefit financially from some of the tactics I lay out.

First some financial stats about the average or middle class American:

- The median household income in 2018 was $63,179.

- 78% of Americans live paycheck to paycheck.

- 60% of Americans do not have at least $500 in a savings account.

- The average American has $5,600 in credit card debt.

- 25% of Americans have NOTHING saved for retirement.

- We spend on average $1,500 a month on non-essential items.

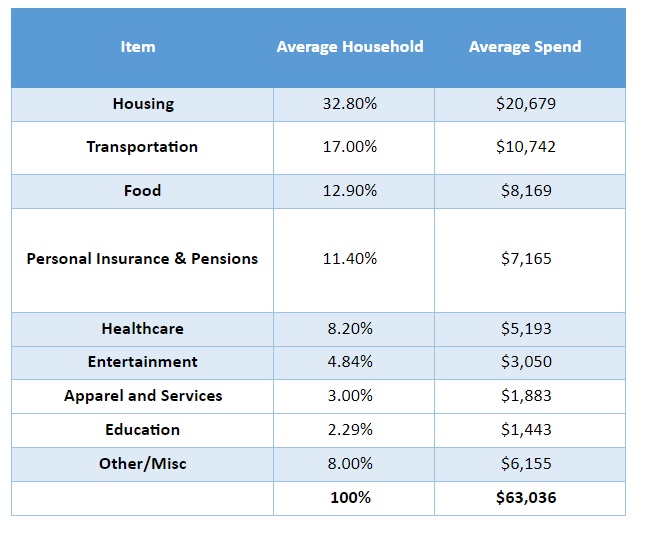

The problem lies in how and on what people are spending money. According to the US Bureau of Labor Statistics the average household spends $63,036 per year of their $63,179 income in the following manner:

The most important thing a person can do to better their financial situation is make a budget, and then audit that budget in such a manner that you end up making more than you spend. This is often measured in a household’s savings rate. Clearly if the average US household is making $63,179 and spending $63,036, then budgeting and saving are not really happening.

So with that, here are some of the biggest money savers for some of the major categories in the above table:

1. Housing – It’s important to live below our means, reduce what isn’t necessary, and don’t overextend ourselves in terms of where we live. This can be accomplished by renting out unused space, buying a property with a guest or rental unit, and investing in real estate long term to offset the monthly cost.

2. Transportation – My recommendation is just this: Unless you need a “nice” car for professional use…go and get the most affordable, reliable, and fuel efficient used car you can – and then drive it until it doesn’t run anymore. The majority of Americans own TOO MUCH car.

3. Taxes – One of the BEST ways to reduce your tax bill – AND invest at the same time – is to make sure you’re taking advantage of your Employer 401(k). This is a tax-advantaged retirement account that allows you to contribute up to $19,500 per year of PRE-TAX money. This means every $1 you contribute to a 401(k) will reduce your taxable income by that very same $1; as a result, you owe less in tax, and have more money leftover to invest. For many people that is a 24-30% return immediately for taxes and a 100% return in the case of the match. In a previous piece, I wrote about the tax advantages of owning a business a well.

4. Dining Out/Restaurants – If you’re dining out, or going to a restaurant, or getting food delivery – avoid doing that out of laziness. However, if your idea of a good time is going out and ordering a nice meal once a week with friends and family, I think that can be a worthwhile experience. I would assert that dining at home with friends can be just as rewarding and honestly a heck of a lot cheaper.

5. Insurance – I think you would be surprised how much you could save with an hour of work, calling around, and comparing personal insurance rates! This alone may cut your insurance bill by 15-20%.

6. Debt Repayment/Credit Cards – Take the approach of cutting back as much as you can, in every possible area, then throwing ALL of that money at the debt with the highest interest rate above 5%.

7. Clothing/Apparel – People are spending too much on apparel! If this is you, go and take a look at your closet, and notice how many clothes you actually end up wearing on a regular basis. Challenge yourself to stop shopping, or cut down your clothing budget by half. That would equate to a significant amount of savings per month.

**Action:

- Audit your spending! This should not take long, as most banks and credit card companies have an ‘export to Excel’ feature. You can find out very quickly where your money is going and to what categories.

- Make a budget. It seems basic, but most people don’t have one. Take a look at those bank/credit card statements and find places to slash your bad money habits.

- Share your best money saving idea in our Facebook Group.**