Recasting vs. Refinance

Rather than our typical write up on personal finance, personal/professional development, and building authentic relationships, this piece is going to be very real estate prescriptive.

Whether or not you currently own a house, it is likely in your future as it is firmly cemented as part of the American Dream. Most people are familiar with the term “mortgage”, and with the historically low interest rates many Americans have learned the term “refinance” and have used them to their advantage. My goal today is to illuminate a lesser known term, the mortgage “recast”. I’ll define it and educate on when you might want to use one versus doing a refinance.

Refinance – Refinancing is the process of obtaining a new mortgage on a property you already own typically in an effort to reduce monthly payments, lower your interest rate, take cash out of your home’s equity, and/or change mortgage companies.

Refinance – Refinancing is the process of obtaining a new mortgage on a property you already own typically in an effort to reduce monthly payments, lower your interest rate, take cash out of your home’s equity, and/or change mortgage companies.

Recast – A mortgage recast is a feature in some types of mortgages where the terms of the mortgage (interest rate, length remaining on the loan, etc.) remain the same but the remaining payments are re-calculated based on a new amortization schedule thus lowering your monthly payment.

So when would you use a mortgage recast instead of a mortgage refinance?

If you have been paying a little extra towards your mortgage over a period of time or you have some extra cash to pay towards your mortgage via a lump sum, you could request a recast. This is especially advantageous if you like your interest rate and you are keen on lowering your payment without incurring the cost of a refinance and without extending the length of your mortgage.

Earlier this year my wife and I recasted our mortgage, lowering our payment by a couple hundred dollars each month. We were able to do this because firstly, we had been paying some extra each month towards the mortgage for the last seven years. Secondly, sometime a while back we threw an extra bit of cash we had at the mortgage. Our bank charged us a $250 fee to recast, and other than that I think it took me about 45 minutes of time beginning to end!

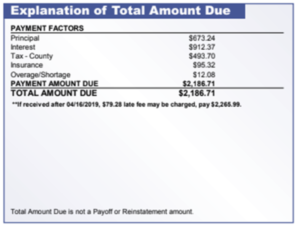

Here was our mortgage payment broken down BEFORE recasting:

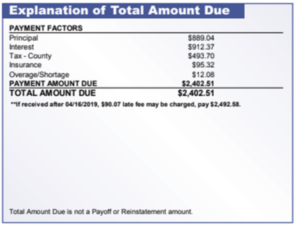

Here was our mortgage payment broken down AFTER recasting:

As you can see, the only line item that changed in the two scenarios was the principal amount of the total payment. Despite the newly minted lower payment, my wife and I plan to leave our monthly payment of $2,500 the same and continue to accelerate paying the mortgage off. However, now we have the flexibility to pay the lower total amount should we choose to.

**Action:

- Does your current mortgage allow recasting? Call your lender to at least find out.

- When you go to get a new mortgage, make sure your servicer is going to allow recasting. It’s a question I’m always going to ask now.

- Email me and let me know if you learned something today. Would love to know if you are considering a recast in your future.**

One Comment

Anita

I had never heard of a recast before – thank you for the info. I’m not in a position to do it now, but hopefully will be able to in the future