If it is NOT Raining Yet, It’s Just a Matter of Time…

Perhaps now more than ever, the coronavirus has demonstrated a need for an emergency fund. We are often advised to have three to six months’ worth of savings available to us for a “rainy day”. However, research shows that only 28% of Americans have any emergency funds at all.

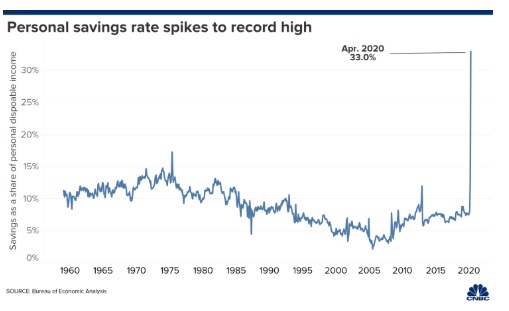

But the pandemic has caused some change. From February to March 2020, the savings rate in America increased by more than 5% according to the Bureau of Economic Analysis (BEA). That had been the highest savings rate since 1981. The impact of quarantining and social distancing really kicked in during the month of April, though (and April pretty much laughed at March and said, “Hold my beer.”). Consumer spending plummeted as people stayed home and millions worried about their jobs. The result? The savings rate in April 2020 was a whopping 33%, a staggering number considering we were averaging just 8% pre-pandemic. Americans have now been forced into saving.

But the pandemic has caused some change. From February to March 2020, the savings rate in America increased by more than 5% according to the Bureau of Economic Analysis (BEA). That had been the highest savings rate since 1981. The impact of quarantining and social distancing really kicked in during the month of April, though (and April pretty much laughed at March and said, “Hold my beer.”). Consumer spending plummeted as people stayed home and millions worried about their jobs. The result? The savings rate in April 2020 was a whopping 33%, a staggering number considering we were averaging just 8% pre-pandemic. Americans have now been forced into saving.

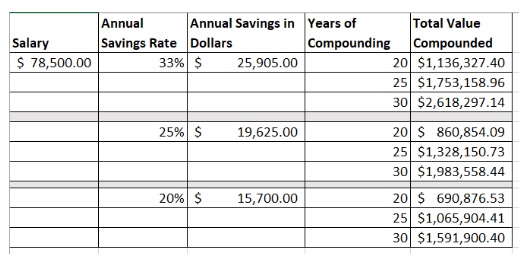

It’s unfortunate that it has taken a virus like this to make it happen. It got me thinking: what if the average American household was willing to make the lifestyle choices necessary to save 33%, 25%, or 20% of their income? Let’s take a look at these savings rates in real dollars and use a compound interest calculator to determine what they might translate to in true savings over time after 20, 25, and 30 years.

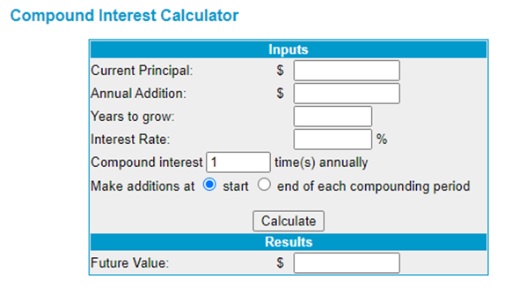

Here is the basic compound interest calculator that I have used for this exercise:

For this, we are going to assume that the person’s current principal is zero. The annual addition will be the savings rate in dollars. Years to grow will be 20, 25, and 30 years. And we’ll pick a modest interest rate of 7%. (Many investments will garner you a greater return than that, but we will stay conservative for this exercise.) So at 7% compounding interest here is how we ended up:

As you can see above, nearly every scenario makes the person a millionaire — and in many cases, a multi-millionaire. This exercise also assumes your income will never fluctuate, which we know to be false. Chances are really good that you can accelerate this process by increasing your salary, but also by increasing your savings rate.

If Americans understood the power of a high savings rate along with compound interest, they would be able to harvest the benefits later in life.

**Action:

- Determine your current savings rate. Are you saving north of 20%? If not, create a budget and see if you can put aside even more on a monthly/annual basis.

- Play with the compound interest calculator and run your own scenarios. You likely have some money invested or saved already. Use that as your “current principal” and add the desired annual funds. Click “Calculate” and see what it returns.

- Take an honest look at the obstacles that stand between you and increasing your savings rate. Consider what steps need to be taken to overcome one or more of those obstacles. Make a plan for working on them.**